Is Your Advisor a Real Fiduciary?

Why it matters to you

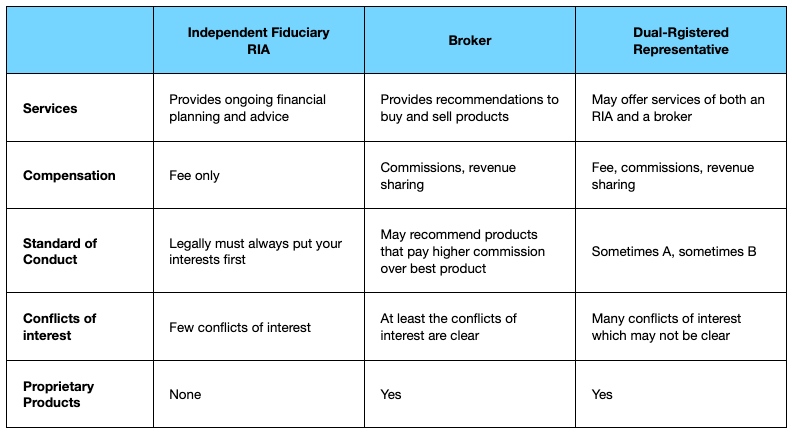

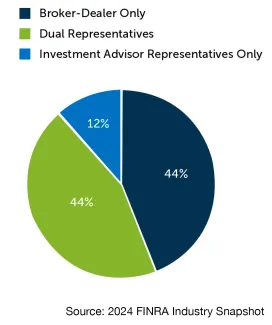

Most of us expect our doctors, lawyers and financial advisors to place our interests first when giving us advice. Wall Street marketers understand this well, which is why the banks have worked hard to blur the distinctions between registered representatives who sell products for broker-dealers and investment advisor representatives who provide planning and advice. Dual-registered advisors now make up almost 8 out 10 individuals holding themselves out as fiduciaries1. Although fiduciary in name, there are important differences between these dual registered (fee-based) advisors, and fee-only advisors.

Differences in both cost and quality

The differences are in both the costs you incur and the quality of the advice you receive. But don't just take our word for it. Professor Nicole Boyson at Northeastern University wrote a paper in 2019, "The worst of both worlds? Dual-registered investment advisers"2 in which she detailed precisely how their clients pay higher fees, are subjected to more conflicts of interest and have lower investment returns. According to Professor Boyson, “While these advisers mostly meet the letter of the law (frequent disciplinary actions aside), their conflicts, high fees, and poor investment management performance imply that they are not serving their clients’ best interests.”2

Problems highlighted in 2023 SEC risk alert

The problems with dual-registration have not been solved. In a 2023 risk alert, "the SEC said it found deficiencies around how firms are disclosing to their customers the capacity in which an advisor is acting, as well as related conflicts. Staffers had observed instances where representatives making an investment recommendation were not disclosing to customers whether they were acting as a commission-based broker or a fee-based investment advisor, according to the SEC."3

How you pay for your advice and how your advisor gets paid matters

The SEC maintains an official position that adequate disclosure is sufficient to mitigate conflicts of interest. The evidence seems to suggest otherwise, and I strongly believe that investors should eliminate as many conflicts of interest as possible by choosing a fee-only advisor.

Duty of care matters too

A fiduciary's duty of loyalty must also be accompanied by their duty of care: this is to say that a fiduciary has the responsibility to be knowledgeable in the areas where they are giving advice, they need to follow a repeatable process, and they need to document how they arrive at their advice.

Our Commitment

At Stone Ridge Advisors, our commitment is to:

- Act as a loyal fiduciary and put our clients' interests first always

- Excel in our work and never take on work that lies outside our competency

- Provide fee-only advice and never accept commissions, referral fees or any other compensation

- Be transparent on fees

- Deliver comprehensive financial planning

- Remain independent from banks, broker dealers, insurance companies and custodians

- Never hold or possess any client securities or money

- Avoid conflicts where possible and disclose those which are unavoidable

- Measure and report client performance using independent third parties

Differences Between Advisor Types

Resources

References

1 2024 Industry Snapshot FINRA 2024

2 The worst of both worlds? Dual-registered investment advisers N. Boyson 2019

3 SEC Puts Dual-Registered Advisors on Notice in Risk Alert AdvisorHub.com 2023