The Creative Investor’s Passport to Global Markets: A Guide to International Diversification

As a creative professional—designer, writer, artist, or entrepreneur—you thrive on new perspectives, diverse influences, and fresh inspiration. The same outlook can help you build a smarter, more resilient investment portfolio: by embracing international diversification.

Most U.S. investors hold only about 20-25% of their equity portfolios in international stocks, despite the fact that roughly 39% of the global stock market lies outside the U.S.[2]. This “home bias” limits your portfolio’s growth potential and risk management.

At Stone Ridge Advisors, we are strong advocates for international diversification, and experts at Morningstar, Dimensional Fund Advisors, Vanguard, and Charles Schwab all agree: diversifying internationally is a key step for long-term success [1][3][5].

Why Go Global?

1. Access a World of Opportunities

The U.S. market is just one part of the global story. 74% of the global economy is outside the U.S. Regions like Europe and Asia, and emerging economies offer sectors, companies, and trends you won’t find at home. As Morningstar notes, non-U.S. stocks have recently surged due to attractive valuations and a weaker dollar, making returns in local currencies even more valuable for U.S. investors[1].

2. Diversification Smooths Out the Ups and Downs

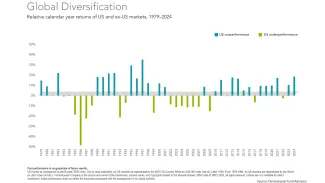

Markets around the world don’t always move in sync. International stocks can perform well when U.S. stocks lag - as the chart illustrates, just as a well-balanced creative project draws strength from many sources. According to Morningstar, a diversified portfolio—including international exposure—has helped investors weather market volatility in 2025[1][3].

3. Currency Diversification Adds Protection

Investing internationally means your assets are exposed to different currencies, which can act as a hedge if the U.S. dollar weakens. This adds another layer of resilience to your portfolio, much like exploring new creative mediums broadens your skillset[3].

4. Avoid the Pitfalls of “Home Bias”

U.S. investors often show a strong preference for domestic stocks, a tendency known as “home bias.” Morningstar explains, investors tend to be more familiar with local companies, but this can limit growth and increase risk[1][3]. Dimensional Fund Advisors also highlights that true global diversification requires dedicated international securities to capture the full opportunity set[2].

What Does the Research Say?

- Morningstar recommends investors keep the faith in non-U.S. equities, especially after years of recent underperformance, and suggests using global market capitalization as a starting point for international allocation[3].

- Dimensional Fund Advisors advocates for a research-driven, broadly diversified approach across countries and sectors to manage risk and pursue long-term returns[4].

- Vanguard and Charles Schwab both emphasize low-cost, broad-based international mutual funds and ETFs as the simplest and most effective way to add global exposure to your portfolio[5].

How to Add International Diversification

You don’t need to become an expert in foreign markets to diversify. Here’s how these trusted sources suggest you get started:

- Use Mutual Funds and ETFs: Dimensional, Vanguard, and Schwab all offer low-cost, broadly diversified funds that give you instant access to international stocks and bonds[1][3].

- Consider Your Needs: If you have a smaller portfolio or just want keep things easy, consider a global balanced mutual fund or ETF. We frequently use Dimensional's Global Allocation 60/40 Portfolio which gives us instant diversification into 15,000 stocks and 1,600 bonds at very low cost[6]. If your portfolio is larger you can build a custom portfolio using ETFs and mutual funds as building blocks. Note that this will need ongoing maintenance (see below).

- Set a Target Allocation: While the ideal allocation varies, the global market is about 60% U.S. and 40% international stocks. Most U.S. investors fall short of this, but aiming for 30-40% international can help you capture broader opportunities[3][4].

- Choose Your Focus: Consider both developed and emerging markets for the most balanced exposure. Emerging markets in particular have shown lower correlations with the U.S., offering even stronger diversification benefits[1].

- Review Regularly: Keep an eye on your portfolio’s balance, and rebalance as needed—just as you’d refine a creative project for the best results.

Final Thoughts for Creative Investors

Diversifying internationally is like adding a world of new colors, textures, and perspectives to your creative process—only this time, it’s your portfolio you’re enriching. Morningstar and Dimensional remind us: not only is it not too late to add international exposure, but doing so can help you build a more resilient, growth-oriented portfolio for the long haul[1][3][4].

Whether you choose funds from Vanguard, Schwab, Dimensional, or a mix, international diversification is a smart step toward a future as rich and varied as your creative ambitions.

Resources

Want to chat? A second opinion? Schedule a free 15 minute call - no strings

Become an insider: I write specifically for creatives like you, Click here to get Creative Wealth Insights as soon as I write them

Click here to read more recent Creative Wealth Insights

Got a topic you want to know more about? Click here to text me

References

- [2] Dimensional Fund Advisors, June 2024 https://www.dimensional.com/ie-en/insights/global-diversification-still-requires-international-securities

- [3] Morningstar, July 2025 https://www.morningstar.com/portfolios/why-its-not-too-late-add-international-exposure

- [4) Dimensional December 2021 https://www.dimensional.com/ca-en/insights/dimensionals-approach-to-asset-allocation

- [5] Dimensional https://www.dimensional.com/us-en/our-philosophy

- [6] Dimensional Global Allocation 60/40 Portfolio https://www.dimensional.com/us-en/funds/dgsix/global-allocation-60-40-portfolio-i

Important Disclaimer

The information in this article is provided for educational and informational purposes only and should not be considered investment advice or recommendations. Investment Advisory services offered through Stone Ridge Advisors LLC, a Registered Investment Adviser. Although reasonable effort is made to check for accuracy, Stone Ridge Advisors is not responsible for errors in third party statements or data. Past performance should not be relied upon for future results. Investing in securities involves the risk of loss up to and including all of the principal and no strategy can guarantee success. Stone Ridge Advisors does not provide legal or tax advice and it is strongly recommended that clients review any decisions with their legal counsel and tax professional.